|

|

|||

Harvard economists study various parameters and pick India ahead of China . |

|||

|

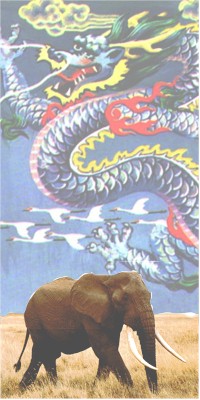

It must come as a relief to many Indians, that Harvard University's Michael Porter and Jeffrey Sachs have brought to light many unobvious parameters with which to evaluate a nation's economic potential. Evaluation of an economy's prospects is not a simple exercise based on a rule-of-three. Frenetic investments in material assets like factories, roads, hotels and airports do not necessarily lead to either sustainable growth or even short term big growth. What drives an economy in the long run, are factors that will enable increasing efficiencies of capital. India's potential: India may have stumbled on to the growth road ahead of China. For all those staring at this statement in disbelief, evidence follows. It seems that competitiveness is the key to success. And that does not depend - in fact cannot- depend on capital flood. Rather an economy builds its competitive edge by cultivating or championing education, creativity, innovation, openness of systems, global outlook and the like. And these lead to better productivity of capital employed. The authors do not list democracy, experimental arts, freedom of expression etc as elements too, but these are probably implied. Too subtle, qualitative and vague? The venerable World Economic Forum [WEF] has published the Global Competitiveness Report 2000, authored by Porter and Sachs, in which they rigorously marshal numbers to create a frame of reference. The report is to be an annual exercise that will enable rankings to be tracked and reviewed. Index futures: To put their methods on a scientific basis, Porter and Sachs have devised two indices: Current Competitive Index [CCI] and Growth Competitive Index [GCI]. Simply put, CCI is about whether a nation can sustain what its economy is now achieving, and GCI is about whether it can exceed the current growth rate. They aim to assign ranks on an annual basis. As a nation climbs higher, its potential will appear to have been realised. No prizes for guessing who leads the lists. The west and a few Asian tigers dominate the top third of about 60 nations. The point of interest is however the race between India and China. It is now almost a routine for the world to marvel at China and be dismissive of India. This gets a lot of Indians in a defeatist mood. In this race between two billion-pop nations, is India a no-hoper? Porter and Sachs disagree. For the year 2000 India places 37th against China's 44 in CCI . India is a close 49 to China's 41 in GCI. In very lay terms, this means that while India may sustain its current growth rates, to improve its position in GCI, India needs more reforms in government and private sectors. If interest rates, corporate governance, infrastructure etc fall in line with world benchmarks, India will climb higher in GCI ranking too. Summing up: For a very succinct summary of the findings of the report, do read a review in Outlook by Paromita Shastri and Shantanu Guha Ray. Their article also carries a bonus: a peek into a survey conducted by the A.T. Kearney Global Business Policy Council. This survey polled 1000 chief executives world-wide on key issues regarding nations' potential. India gains plus marks for all that will endure: emphasis on education, technical capability, large markets, ability to absorb technology etc. The points that India scores poorly at, are mercifully correctible over time: obdurate bureaucracy, high interest rates, infrastructure bottle-necks etc. Finally, the July 8,2001 issue of BusinessWorld carries a gem of a column by Niranjan Rajadhyaksha who clinches the verdict in the India v. China debate in India's favour: "The Indian economy has grown at an average rate of 6.4% since 1992. China has done far better: its economic growth rate has been close to 10% right through the 90s. The differential in growth rates has ensured that India has been dismissed as a loser for long.... "But look at the comparative record in a more subtle way. How much investment was required to propel these growth rates? India's gross domestic investment as a proportion of GDP has been about 24% China's corresponding rate has almost been 39%. Besides that China pulls in some $40 billion of foreign direct investment every year, or 4% of its GDP. In contrast India gets hardly $3 billion a year in foreign investments. "What does all this add up to? China has been growing about 55% faster than India though it invests 80% more. The only conclusion I can arrive at is that India uses capital more productively." Dissenting voices: In all fairness, it must be noted that there are several respectable scholarly voices that disagree with competitiveness indices developed by Porter and Sachs. Sanjaya Lall of Queen Elizabeth College, Oxford is a serious critic. In a paper [available at this link as a PDF file] , Lall concludes that, "competitiveness indices have weak theoretical and empirical foundations and may be misleading for analytical and policy purposes."Lall's basic complaint is that indices as they are now presented, apply to 'perfect markets', whereas in fact, developing economies have to cope with imperfect ones, that need strategic interventions. Backing Lall is Prof. Paul Krugman who says, "when economies trade with each other they do not (as firms do) compete in a confrontational manner. They engage in a non-zero sum game that benefits all parties." Competitiveness therefore does not come into play very much. Lall also questions the methods: "While it is true that many relevant pieces of information cannot be quantified, it is surprising that those that can are not. The extensive use of responses from businesses across the world conceals many ambiguities and weaknesses. These questions are posed in an ambiguous manner and relate to questionable hypotheses. They are combined into indices at various levels using weights that are difficult to justify. The resulting indices are presented as magisterial pronouncements on various aspects of performance. They are subjected to statistical analysis to prove their validity and to provide insights into sustainability, under-performance and so on and so to provide policy makers with further guidance on areas of competitive weakness. This impressive pyramid of analysis and results rests on a rather small, inadequate and often suspect base." Strong words indeed. Where do these leave India? A sober way of looking at the indices may be to view them not as absolute numbers but as qualitative comparisons. The markets may not indeed be perfect in the developing world right now, but when they do mature in the long run, India may come to prevail over China as a rugged competitor. It may be erroneous to compare India and China with developed nations using these indices, but the indices may be reasonably valid when India and China are compared to each other. Thus this image: The elephant may be slow but it is real and a long distance runner. The dragon, for all its awesomeness, is a mythical animal. July,2001

|

Updates:

|

||