|

|

|||

The National Stock Exchange was a fitting response to the Wild West that was the 1990s' BSE. |

|||

|

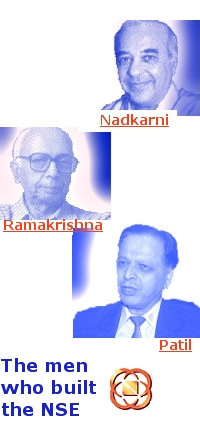

The National Stock Exchange [NSE] is today a nation wide, wireless stock trading system that has earned the trust and respect of all Indians. It is one of the largest systems of its kind in the world: with a satellite hub and over 3000 --going on 4000-- VSAT spokes. Since it went online on Nov 4,1994 -- amidst fond predictions by vested interests of its early demise-- NSE has grown unstoppably. The pace maker: In about a year,its volume exceeded that of the shark infested Bombay Stock Exchange [BSE]. Today, --after about eight years-- it serves 400 cities and offers over 700 companies to trade in. Small town Indian has --because of the NSE-- imbibed the equity cult. The slimy jobber-broker cabal of old has been shoved aside by the wysiwyg screen based system. The forgers and system cloggers pushing papers around have been edged out by dematerialsed [Dmat] shares. The poker players with little in their pockets who created huge payment crises have been stymied by an emerging rolling system of payments. And wonder of wonders, the foggy 'badla' system --that no one understood or benefited by, except the legatees of its ancient creators-- has been replaced by a state of the art futures and options facility. The effect of NSE on India's economic regeneration is also significant. The transparency it has come to stand for has brought in foreign investors. It has made companies and broking firms behave -- or else. It is the platform on which every modern feature of world's financial markets is becoming available. The credibility it has developed by smoothly carrying out over 300 settlements, by rarely failing either because of hardware or software, by attracting steely professionals to its corporate employ is beginning to pay off: NSE is in demand to set up similar systems in many countries. Ashes of greed: Just ten years ago Indian stock markets were a mine field. The individual investor was routinely being ripped off. He would give his buy/sell order to his broker whose jobber would then disappear into a sweaty, shouting ring called the stock exchange. Throughout the trading hours he would be inaccessible. When he finally emerged it would turn out that he either sold for you at the lowest price or bought at the highest. Then began the share transfer dance, with excursions into mismatched signatures, forged certificates, simple bankruptcies and crawling share registries. Finally, about a month after the deal began you could entertain thoughts of payments from your broker. The stock exchanges were a haven for the crooked. Big players operated in collusion with banks, institutions, listed companies and toothless boards of the exchanges. Harshad Mehta that media darling was not the only greed merchant. [This epitaph to him summarises his notoriety forever.] There were many others but it was his outrageous daring what in the end provoked corrective measures. Harshad Mehta may even be considered the great motivator for the reforms that followed. In the early 1990s India had begun to take the first steps towards adopting best practices of the world. India found the men equal to the task. S S Nadkarni at IDBI was an enthusiastic champion of an open, online stock trading system. A consortium of IDBI and several financial institutions promoted and registered NSE as a corporate body in 1992. As well meaning foreign friends watched and condescended that it would take about 8 to 10 years for the system become mature, NSE raced to go online in 2 years and go rapidly up to the maturity plateau. Its software was entirely Indian. The infrastructure was modern but made fail safe in Indian conditions. Dr. R H Patil, the first Managing Director of NSE with a brilliant deputy in Ravi Narain mid-wifed and nursed the new baby. G V Ramakrishna heading the SEBI [Securities and Exchanges Board of India] held the success of the emerging NSE as a model and rammed home many reforms on the BSE. He was a rare man for the sharks to contend with: he was beyond greed. Foreign investors began to switch their patronage to the NSE. And, finally when scare mongering would not work any more, the BSE paid the ultimate tribute to the NSE: it too went online! The lady who first blew the whistle on Harshad Mehta's machinations was journalist Sucheta Dalal. This, when mainstream media was in his thrall, publishing his self-serving theories without any analysis. She is fearless. Almost exactly 10 year after the Harshad Mehta saga, another scam -- this time with Ketan Parikh in starring role -- exploded. But the fall-out was far less, despite much foot dragging and fuzzy thinking by regulators. This scam also set in motion another round of reforms and fine tuning. In an online chat Sucheta criticised the management of the Parikh crisis, but she also averred: "In real terms the system has indeed changed a lot." There is room for hope now that the NSE --with an activist SEBI in concert-- will emerge as a reliable crook buster. Sucheta Dalal paid a handsome tribute to the NSE on its 5th birthday. It is a gripping read -- indeed, much of this article is based on it. It was originally published in the Economic and Political Weekly. While Sucheta has given her consent for its reproduction at GoodNewsIndia, the Weekly has not responded to requests. You can read it -- off site -- in a separate window by clicking the button below. Remember also, that the NSE has since gone on to fulfil much of her wish-list. March,2002

|

|

||